If you have an aptitude for convincing people and can identify what insurance works for different customers, then an insurance agency business might work for you.

An insurance agency is not only profitable, but also requires lesser skills to get started. But at the same time, it attracts a lot of competition. Moreover, it is also a work that involves a lot of responsibility for managing insurance portfolios properly.

You can do all of the above and more smoothly, with the help of an insurance agent business plan.

If you are planning to be an insurance agent, the first thing you will need is a business plan. Use our sample insurance agent business plan created using Upmetrics business plan software to start writing your business plan in no time.

Before you start writing your business plan, spend as much time as you can reading through some samples of insurance & finance-related business.

The insurance industry stood at a massive value of 1.28 trillion dollars in 2020 and isn’t about to slow down any time soon.

Life and home insurance make up the majority of the market share. The growth of the industry can be attributed to the increase in buying houses and getting the same insured.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

Different legal structures come with different pros and cons. Also, each legal structure solves different purposes for a business. From the taxes, you’ll pay to the liability on your assets, the legal structure of your business decides everything.

Hence, you should go through all of your options and pick the one that fits your business needs the best.

Read More: How to Determine the Legal Structure of Your BusinessHaving a brand identity that makes you memorable to your customers is important. Constant marketing and branding efforts can help you achieve that.

Moreover, your brand image should give your customers a sense of reliability. It is of utmost importance to your business.

Figuring out what licenses and permits you need as per the laws of your country and state is very important before getting started in the insurance industry.

But at the same time, keeping track of all the legal requirements can be difficult. Hence, it is a good practice to have a checklist at hand before you get started.

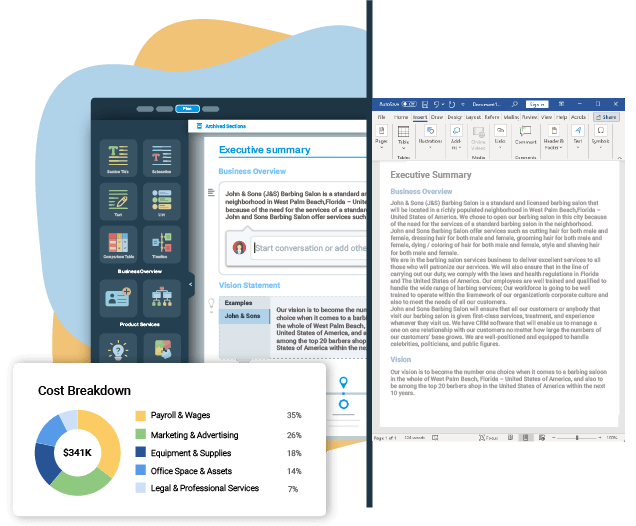

Read More: What Licenses and Permits are needed to Start a BusinessThe cost of setting up an insurance company depends upon the location and size of your business. Hence, look into what would be your financial requirements to set up your firm and if you’ll need any funds or not.

There are several funding options like angel investors, bank loans, etc. You can pick the option that works best for you.

Reading sample business plans will give you a good idea of your aim. It will also show you the different sections that different entrepreneurs include and the language they use to write about themselves and their business plans.

We have created this sample insurance agent business plan for you to get a good idea about how a perfect insurance agent business plan should look like and what details you will need to include in your stunning business plan.

This is the standard insurance agent business plan outline which will cover all important sections that you should include in your business plan.

After getting started with Upmetrics, you can copy this sample insurance agent business plan into your business plan and modify the required information and download your insurance agent business plan pdf or doc file.

It’s the fastest and easiest way to start writing your business plan.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Need help writing your business plan from scratch? Here you go; download our free insurance agent business plan pdf to start.

It’s a modern business plan template specifically designed for your insurance agent business. Use the example business plan as a guide for writing your own.

About the Author

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan